Plan 1: Student Life Strategies for UK Universities

When you're starting uni in the UK, Plan 1, a practical framework for navigating student life with clear, actionable steps. Also known as student survival planning, it's not about fancy schedules or rigid routines—it's about knowing what to do before problems hit. Whether you're dealing with a leaking roof, a surprise medical bill, or a packed timetable, Plan 1 means having a go-to system that cuts through the noise.

Plan 1 connects directly to things like student health services, free NHS care, GP registration, and mental health support tailored for students, and university accommodations, the messy, overpriced, but unavoidable housing options students face. It also ties into UK student budgets, how much you really spend on food, transport, and phone bills each month. These aren’t separate issues—they’re parts of the same puzzle. You can’t manage your diabetes without knowing how to register with a GP. You can’t save on rent if you don’t understand water meters or landlord responsibilities. And you won’t stick to a budget if you don’t know where your money actually goes.

Plan 1 isn’t theoretical. It’s what you use when you’re trying to figure out if your £120 monthly phone bill is fair, or when you’re wondering if you should take a gap year, or when you’re staring at a cockroach in your kitchen and need to know your rights. It’s why students who register with a GP early, set up direct debits before term starts, and learn how to use Zotero for references end up less stressed and more in control. It’s why some students sleep better, pay less, and still go out on Friday nights.

Below, you’ll find real guides written by students who’ve been there—no fluff, no marketing spin. From how to get free contraception to how to catch a £10 train to Edinburgh, these are the tools and tricks that actually make a difference. This isn’t a list of random tips. It’s a collection of Plan 1 in action.

Published on Feb 3

0 Comments

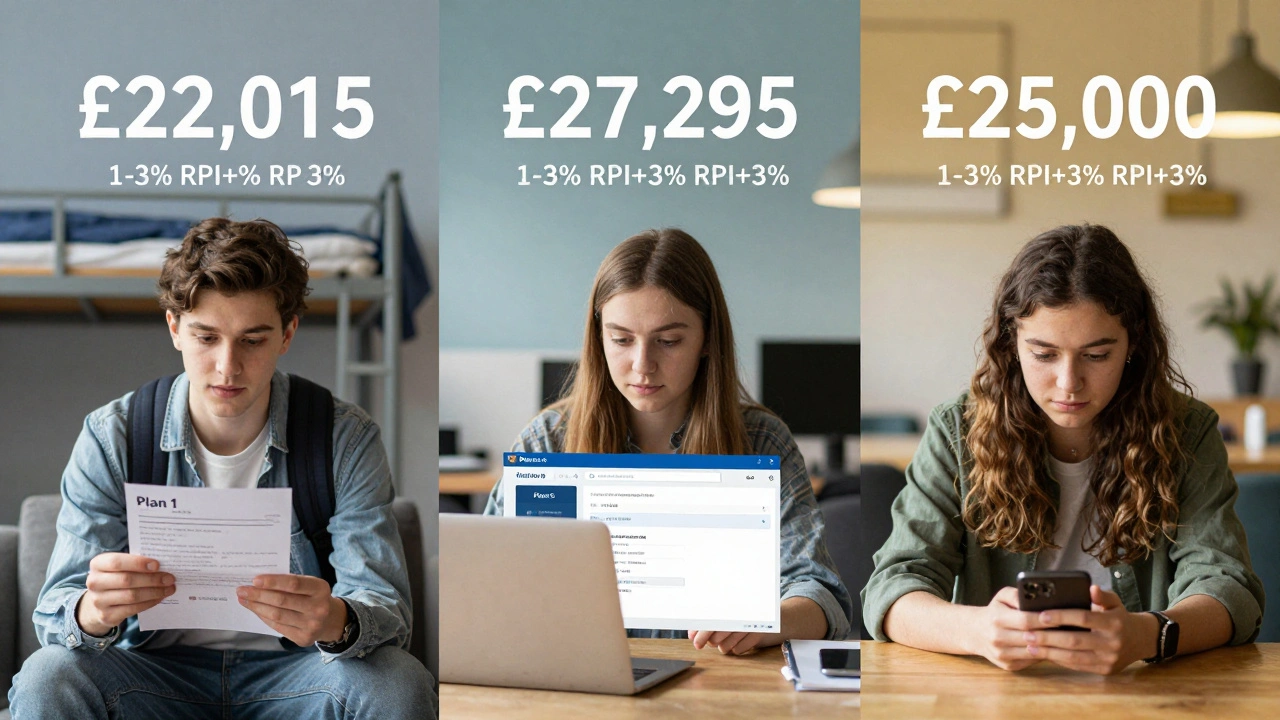

Understand how UK student loans Plans 1-5 work, including repayment thresholds, interest rates, and what happens if you move abroad. No jargon, just clear facts.

Published on Nov 26

0 Comments

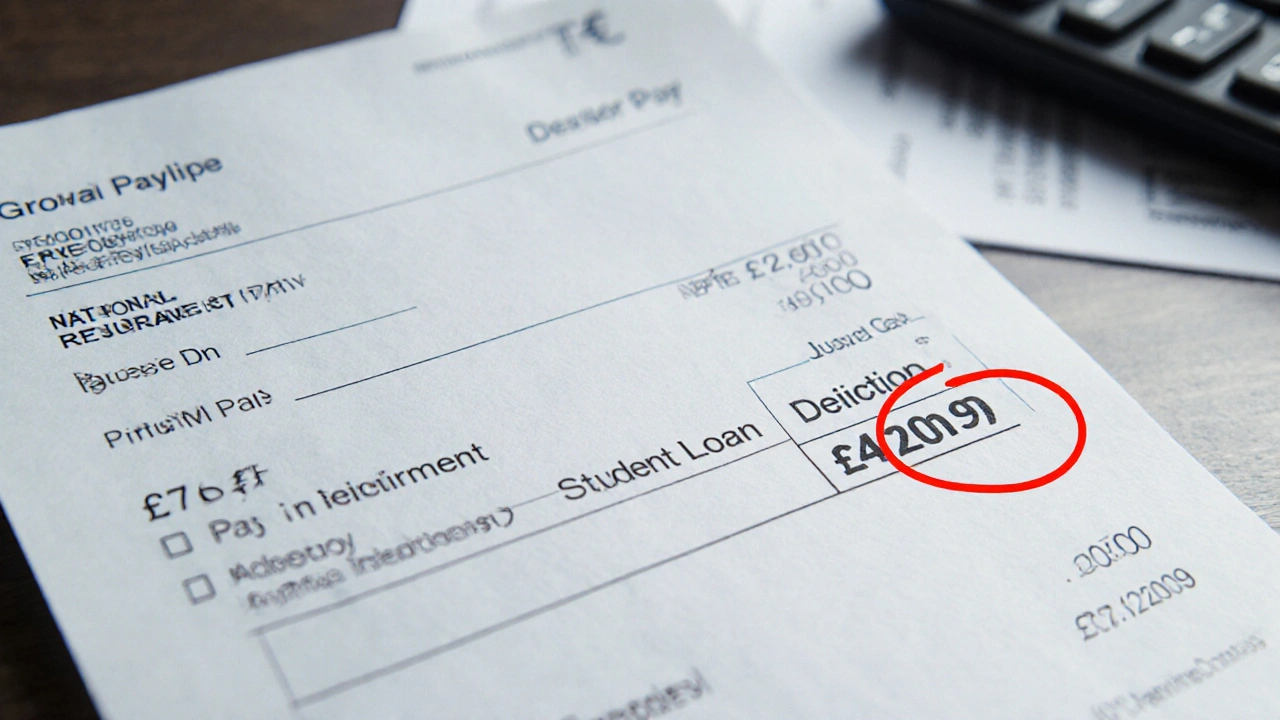

Learn how to read your UK payslip to track student loan repayments, understand Plan 1 and Plan 2 thresholds, spot overpayments, and ensure you're paying the right amount each month.