If you’re thinking about studying in the UK, or you already are, you’ve probably heard the term UK student loans thrown around. But what do Plans 1 through 5 actually mean? And why does it matter which one you’re on? The truth is, these plans aren’t just bureaucratic labels-they directly affect how much you pay back, when you start paying, and even whether you’ll pay off the full amount. This isn’t about memorizing numbers. It’s about knowing what’s really happening with your money.

How UK Student Loans Work (The Big Picture)

Unlike loans in the U.S., UK student loans aren’t designed to be paid off quickly. They’re income-contingent. That means your repayments go up or down based on how much you earn-not how much you borrowed. You don’t pay anything until you’re making over a certain threshold. And if you never reach that income level? You might never pay it all back. That’s not a loophole. It’s how the system is built.

The loan is split into two parts: tuition fees (paid directly to your university) and maintenance loans (paid to you for living costs). Both are covered under the same repayment plan. The amount you borrow doesn’t change your monthly payment. Only your salary does.

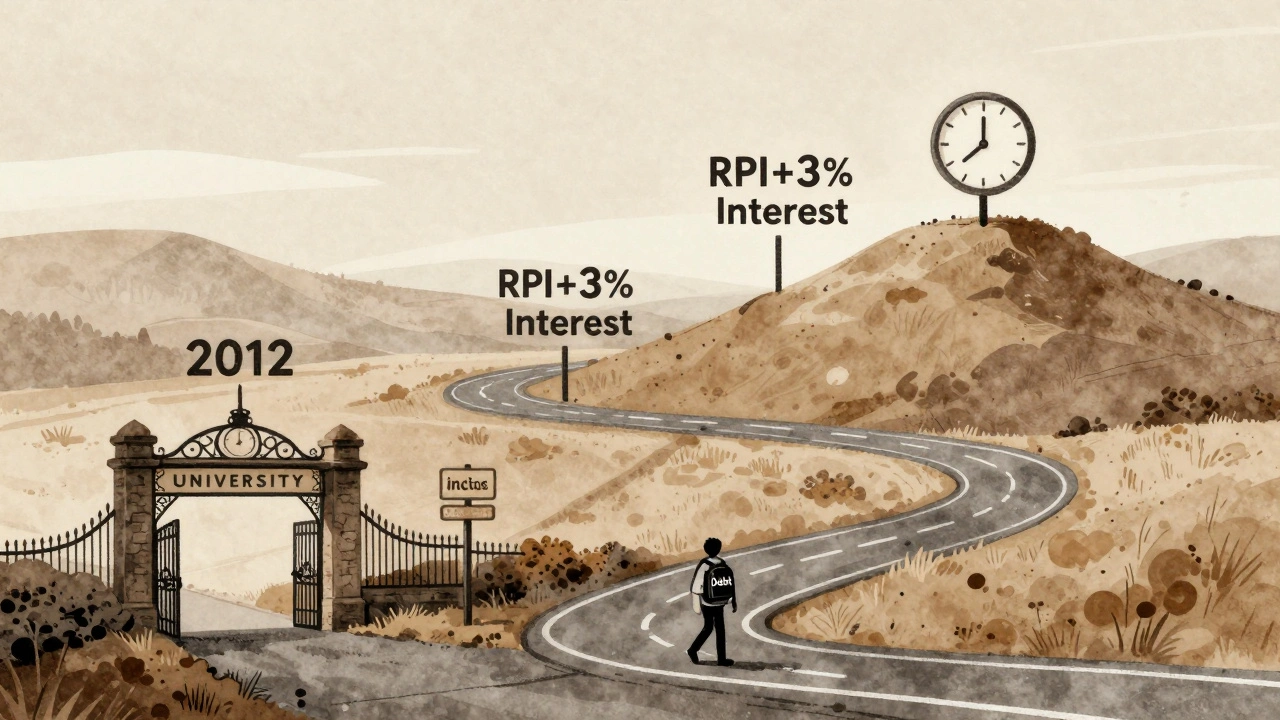

Interest is charged from day one. But it’s not compound interest like a credit card. It’s tied to inflation (RPI) or your income, depending on your plan. And after 30 years, any remaining balance is wiped clean-no matter how much is left.

Plan 1: The Old System (Mostly for Pre-2012 Students)

If you started university before September 2012 in England or Wales, or anytime in Northern Ireland, you’re likely on Plan 1. Scotland has its own system, so we’ll leave that aside for now.

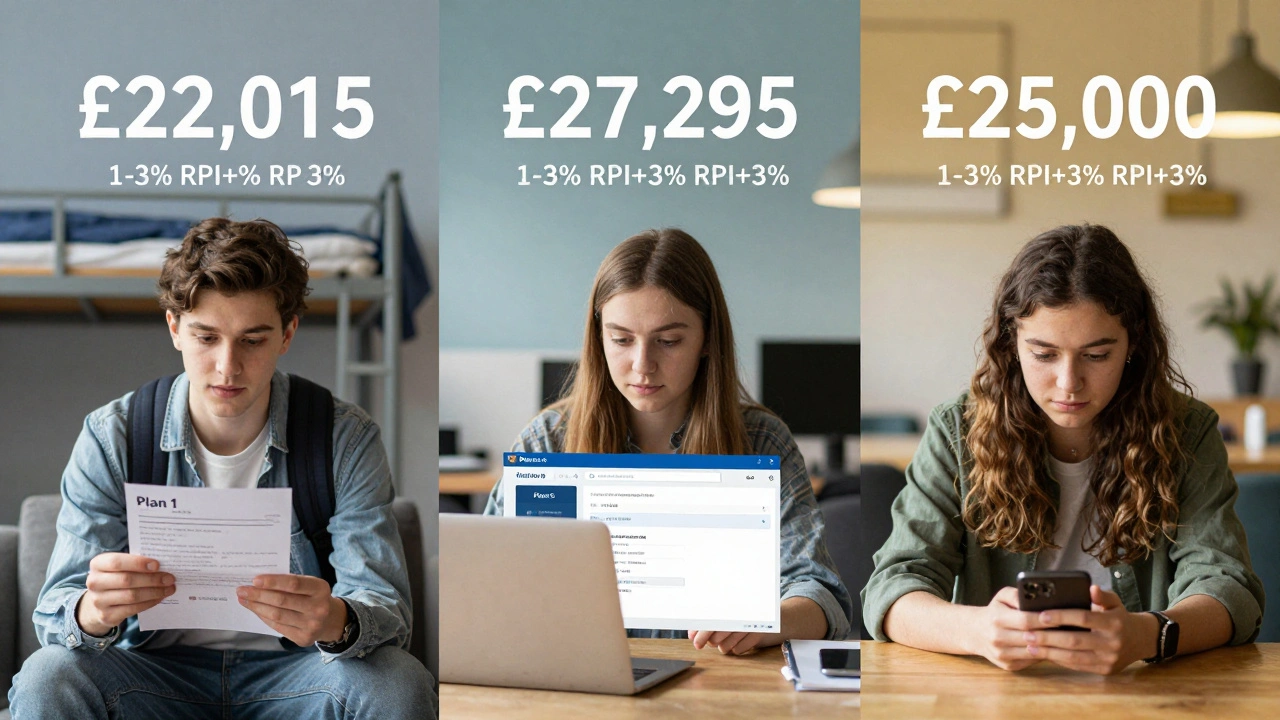

Plan 1 has a repayment threshold of £22,015 per year (as of 2026). You pay back 9% of everything you earn above that. So if you make £30,000 a year, you pay 9% of £7,985-that’s £718.65 annually, or about £60 a month.

Interest is set at the lower of either the Bank of England base rate plus 1% or the previous March’s Retail Price Index (RPI). In recent years, that’s been around 1-3%. It’s low, but it still adds up over time.

Plan 1 loans are older, and many borrowers are now well into repayment. But if you’re still paying, it’s likely you’ll pay less overall than someone on newer plans. That’s because the threshold is lower, and the interest rate is more predictable.

Plan 2: The New Standard (Post-2012 England & Wales)

This is the most common plan today. If you started university in England or Wales after September 2012, you’re on Plan 2. It’s also used by some postgraduate students.

The repayment threshold is higher: £27,295 per year (2026 rate). You still pay 9% of earnings above that. So if you earn £35,000, you pay 9% of £7,705 = £693.45 per year, or £58 a month.

Here’s the big difference: interest. Plan 2 uses RPI + 3% while you’re studying. Once you graduate and start earning, it switches based on your income:

- Below £27,295 → RPI only

- £27,295-£49,130 → RPI + 0% to 3% (gradually increasing)

- Above £49,130 → RPI + 3%

That means if you earn £60,000, your interest rate jumps to RPI + 3%. In 2025, RPI was around 2.7%, so your loan was charging 5.7% interest. That’s a lot more than Plan 1. It’s why many people on Plan 2 end up paying far more over time-even if they never fully repay the balance.

Plan 3: Postgraduate Loans

Plan 3 is for master’s degrees (PGCEs, MAs, MBAs, etc.) taken out since 2016. It’s not for undergrads. The loan covers tuition and living costs, up to £12,471 for most students in 2026.

Repayment threshold: £27,295 per year. Same as Plan 2. You pay 6% of earnings above that. So if you make £35,000, you pay 6% of £7,705 = £462.30 per year, or £38 a month.

Interest is fixed at RPI + 3% from day one, no matter your income. That’s the same as the top rate on Plan 2, but you’re paying only 6% instead of 9%. That makes it cheaper monthly, but the interest still compounds fast.

Many people don’t realize that Plan 3 is separate from their undergraduate loan. You’ll have two repayment deductions taken from your salary if you have both. That’s why some postgrads feel overwhelmed-they’re paying two loans at once.

Plan 4: Scottish Students

Scotland runs its own student finance system. If you’re a Scottish student studying anywhere in the UK, you’re on Plan 4. If you’re from elsewhere studying in Scotland, you’re on Plan 1 or 2, depending on when you started.

Plan 4 has a threshold of £25,000 (2026). You pay 9% of earnings above that. So at £35,000, you pay 9% of £10,000 = £900 per year.

Interest is set at RPI + 1% while you’re studying. After graduation, it becomes RPI until you earn over £25,000. Then it increases to RPI + 3% once you hit £35,000. That’s a hybrid system-lower than Plan 2 for middle earners, but still steep at the top.

One big advantage: tuition is free for Scottish students studying in Scotland. So many Plan 4 borrowers only take out maintenance loans. That means their total debt is often much smaller than someone on Plan 2.

Plan 5: The New Graduate Loan (2023 Onward)

Plan 5 is the newest. It launched in 2023 for students starting university in England and Wales. It’s meant to replace Plan 2, but both are still running side by side for now.

Threshold: £25,000 per year. That’s lower than Plan 2. You pay 9% of earnings above that-same as before.

But here’s the twist: interest is capped at RPI + 3% regardless of income. No sliding scale. So even if you earn £100,000, your interest rate stays at RPI + 3%. That’s actually better than Plan 2 for high earners.

Also, the repayment period is now 40 years instead of 30. That means smaller monthly payments, but you’ll pay more in interest over time. The government says this makes loans more affordable for low earners. Critics say it just pushes the cost onto future taxpayers.

Plan 5 also introduced a new feature: automatic loan forgiveness after 40 years, even if you’ve paid more than you borrowed. That’s never happened before.

What Plan Are You On? (And How to Check)

You don’t get to choose your plan. It’s determined by when you started, where you’re from, and what you’re studying.

To find out which one you’re on:

- Log into your Student Finance England, Student Awards Agency Scotland, or Student Finance Northern Ireland account.

- Look for your loan type under "Your Loan Details" or "Repayment Plan".

- If you’re unsure, call the helpline. They’ll tell you exactly which plan you’re on.

Don’t guess. Getting this wrong could mean overpaying-or missing out on benefits.

Real-Life Scenarios: What It Actually Costs

Let’s say you graduated in 2022 with £40,000 in debt.

- Plan 1: You earn £28,000. You pay £540/year. After 30 years, you’ve paid £16,200. The rest is forgiven. You never paid it off, but you didn’t lose.

- Plan 2: Same salary. You pay £540/year. But interest is 5.7%. After 30 years, you’ve paid £18,000-and still owe £32,000. That’s because interest grew faster than you paid.

- Plan 5: You earn £65,000. You pay £3,600/year. Interest is capped at 5.7%. After 40 years, you’ve paid £144,000. The system forgives the rest-even though you paid more than you borrowed.

That’s the weird part: the system isn’t designed to make you pay back everything. It’s designed to make higher earners pay more, and lower earners pay less-or nothing.

What Happens If You Move Abroad?

If you move outside the UK, you still owe the loan. You must notify Student Finance. They’ll ask for your overseas income and set up direct payments. If you don’t report it, you could face penalties or even legal action.

Thresholds adjust for cost of living. In the U.S., for example, the equivalent of £27,295 might be around $40,000. You pay 9% over that.

Many people think moving abroad erases their debt. It doesn’t. The UK government has agreements with Australia, Canada, and the U.S. to track income. They’ll find you.

Common Myths Debunked

- Myth: "I’ll never pay it back, so I should just ignore it."

Truth: You still need to report income. Ignoring it can hurt your credit, block future loans, or trigger legal action. - Myth: "Paying extra will save me money."

Truth: Not really. Because interest is tied to inflation, paying early doesn’t reduce the total like a mortgage. You’re better off investing the money. - Myth: "My parents have to pay if I can’t."

Truth: Student loans are individual. Parents are never legally responsible.

What Should You Do Now?

First, know your plan. Log in. Write it down.

Second, track your income. Use a spreadsheet. See how much you’re paying each month. Is it more than you expected?

Third, don’t panic if you’re not paying much. That’s normal. Most people don’t pay off their loans in full. The system is designed that way.

Fourth, if you’re earning over £50,000, consider whether you want to pay extra. But only if you have no other debt and are already saving for retirement. Otherwise, let the system do its job.

Finally, remember: this isn’t a punishment. It’s a social contract. You’re paying back part of the cost of your education based on what you can afford. And if you never earn enough? The system absorbs the loss. That’s the trade-off.

How do I know which UK student loan plan I’m on?

Log into your Student Finance account online-whether it’s Student Finance England, SAAS in Scotland, or Student Finance Northern Ireland. Your plan will be listed under "Your Loan Details" or "Repayment Plan". If you’re unsure, call the helpline. They’ll confirm your plan based on your student ID and start date.

Do I have to pay back my student loan if I move abroad?

Yes. If you move outside the UK, you must notify Student Finance and report your overseas income. They’ll calculate your repayments based on local income thresholds. Countries like the U.S., Canada, and Australia have agreements with the UK to share income data. Failing to report can result in penalties or legal action.

Can I pay off my UK student loan early?

Yes, you can make voluntary payments at any time. But it’s rarely worth it. Since interest is tied to inflation and you only pay 9% of earnings above the threshold, paying early doesn’t save you much. The money is better used for savings, investments, or paying off higher-interest debt like credit cards.

What happens if I never earn over the repayment threshold?

You never pay anything. Your loan is forgiven after 30 years (Plan 1, 2, 3, 4) or 40 years (Plan 5), regardless of how much you’ve paid. Many people-especially those in lower-income jobs-will never repay the full amount. That’s how the system is designed.

Is there a difference between Plan 2 and Plan 5?

Yes. Plan 2 has a higher threshold (£27,295) and variable interest based on income. Plan 5 has a lower threshold (£25,000) but fixed interest capped at RPI + 3%, no matter how much you earn. Plan 5 also has a 40-year repayment term instead of 30. Plan 5 is newer and designed to be more affordable for low earners, but costs more over time.