If you’re working in the UK and have a student loan, you’ve probably noticed a deduction on your payslip that says something like ‘Student Loan’ or ‘SL Repayment’. But how do you know if it’s right? And what happens if you’re paying too much-or not enough? Tracking your UK student loan repayments isn’t complicated, but it’s easy to miss the details. This guide shows you exactly where to look, what numbers to check, and how to make sure you’re on track.

Understand Your Loan Plan

First, you need to know which repayment plan you’re on. The UK has two main plans for most graduates: Plan 1 and Plan 2. There’s also Plan 4 for postgraduate loans, but that’s less common for undergraduates.- Plan 1: For students who started university before September 2012 in England or Wales, or anyone who studied in Scotland or Northern Ireland. You pay 9% of your income over £22,010 per year (2025/26 tax year).

- Plan 2: For students who started university in England or Wales on or after September 2012. You pay 9% of your income over £27,295 per year (2025/26 tax year).

These thresholds are annual. Your employer doesn’t look at your yearly income-they take your monthly or weekly pay, convert it to an annual equivalent, and deduct based on that. So if you earn £2,500 a month, your employer calculates: £2,500 × 12 = £30,000. Since that’s above £27,295, they deduct 9% of the amount over the threshold.

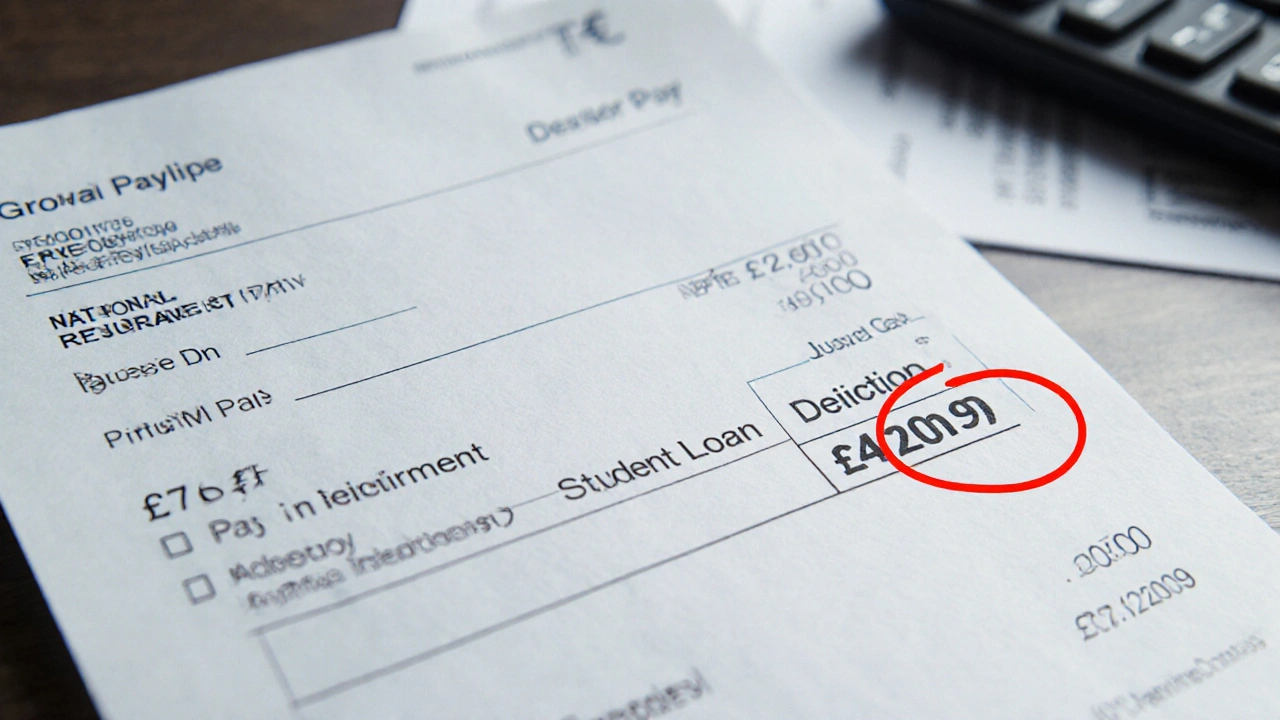

Where to Find the Deduction on Your Payslip

Your student loan repayment won’t always be labeled clearly. Look for these common names:- Student Loan

- SL Repayment

- Plan 1/Plan 2

- HECS-HELP (if you’re an Australian student working in the UK)

It’s usually listed under Deductions or Other Deductions. It’s not a tax-it’s a repayment, so it won’t appear with PAYE or National Insurance. If you don’t see it listed at all, you might be under the threshold, or your employer hasn’t been told you have a loan.

Check your payslip every month. Don’t assume it’s the same amount. If you get a bonus, overtime, or work extra hours, your deduction will go up. If you’re on a zero-hours contract and your pay drops, your repayment should drop too.

How the Deduction Is Calculated

Let’s say you’re on Plan 2 and earn £2,800 a month. Here’s how the math works:- Annualize your pay: £2,800 × 12 = £33,600

- Subtract the threshold: £33,600 − £27,295 = £6,305

- Take 9% of that: £6,305 × 0.09 = £567.45 per year

- Divide by 12: £567.45 ÷ 12 = £47.29 per month

So your payslip should show £47.29 deducted for your student loan. If it shows £50 or £45, something’s off. Small differences can happen due to rounding, but anything over £2 off needs checking.

Some employers use payroll software that rounds up to the nearest pound. That’s legal, but you should still be able to track it over time. If you’re consistently paying £50 when you should pay £47, you’re overpaying by £36 a year. It adds up.

What If You’re Paid Weekly or Fortnightly?

The same rules apply. Convert your pay to an annual figure first.Example: You earn £600 a week.

- Annual: £600 × 52 = £31,200

- Over threshold: £31,200 − £27,295 = £3,905

- 9% of £3,905 = £351.45 per year

- Weekly deduction: £351.45 ÷ 52 = £6.76

Your payslip should show £6.76. If it shows £7, that’s fine. If it shows £10, you’re being overcharged.

Some payroll systems use a simplified method-like assuming you earn the same every week and applying a flat rate. That’s acceptable as long as it’s accurate over the year. But if you change jobs, start a second job, or have irregular hours, the system might get confused.

What Happens If You Have Two Jobs?

This is where things get tricky. If you have two jobs, your student loan repayment should only be taken from your main job-unless HMRC tells your second employer to deduct it too.Here’s how it works:

- Your main employer gets your tax code (like 1257L) and knows you have a student loan.

- Your second employer gets a tax code like BR (Basic Rate) or 0T, which means they don’t know about your loan.

- They deduct tax and NI, but not your student loan repayment.

But if your second job pushes your total income over the threshold, you might still owe repayments. The system doesn’t automatically add up your income from both jobs. That’s your responsibility.

If you earn £20,000 at your main job and £8,000 at your second job, your total is £28,000-above the Plan 2 threshold. You’ll owe repayments on £705 (£28,000 − £27,295). That’s £63.45 for the year. But if your second employer doesn’t deduct anything, you’ll need to pay it yourself when you file your Self Assessment tax return.

Most people don’t file Self Assessment unless they’re self-employed. So if you have two jobs and earn over the threshold, you should contact HMRC to ask for a tax code adjustment. They’ll update your main employer’s records to include the correct repayment amount.

How to Check If You’re Paying Too Much

You can check your total repayments by logging into your Student Loans Company (SLC) account. It shows how much you’ve paid so far, your current balance, and your repayment plan details.Compare that to what you’ve paid through your payslips. Add up all the deductions from the last 12 months. If it’s more than you should have paid based on your income, you’ve overpaid.

Overpayments happen often. Common reasons:

- You changed jobs and your new employer didn’t update your tax code

- You had a temporary pay rise

- You had two jobs and the second one pushed you over the threshold

- Your employer used an outdated threshold

If you’ve overpaid, you don’t need to chase it down. The SLC automatically refunds overpayments. They’ll send you a letter or email once they’ve processed it-usually within 6 to 8 weeks after the tax year ends (April 5). You can also call them if you think you’re due a refund.

What to Do If You’re Not Paying Enough

If your payslip shows no deduction but you’re earning over the threshold, you might be in arrears. This can happen if:- Your employer doesn’t know you have a loan

- You started a new job and HMRC hasn’t updated their records

- You’re self-employed and haven’t filed a Self Assessment

If you’re employed and your payslip shows no deduction, contact HMRC. They’ll send your employer a notice to start deductions. If you’re self-employed, you’ll need to file a Self Assessment tax return and pay your loan repayment directly to HMRC.

Don’t ignore it. The SLC doesn’t charge interest on arrears, but they can adjust your future repayments to catch up. If you owe £500 in unpaid repayments, they might increase your monthly deduction by £50 for 10 months.

When Do Repayments Stop?

Your repayments stop when one of these happens:- You’ve paid off your full loan balance (including interest)

- You reach the repayment deadline: 30 years after the April you were first due to repay

- You die or become permanently disabled

Most people never pay off their full loan. The debt is written off after 30 years. So if you started university in 2015, your loan will be cleared in 2045-even if you’ve only paid back half.

That’s why tracking your repayments matters. You don’t need to pay more than you have to. If you’re earning £30,000 and paying £200 a year, that’s fine. You’re not losing money-you’re paying for a benefit you received.

Keep a Simple Record

You don’t need fancy software. Just keep a notebook or a spreadsheet with:- Month and year

- Your gross pay

- Your student loan deduction

- Any notes (e.g., ‘bonus’, ‘second job’, ‘new employer’)

Do this for six months. Then compare it to your SLC statement. You’ll quickly see if things line up. If they don’t, you’ll know exactly when the problem started-and who to contact.

Final Tip: Don’t Panic About Small Differences

Payroll systems aren’t perfect. A £1 or £2 difference per month? It’s probably rounding. Over a year, that’s £12 to £24. The SLC will adjust it automatically.But if you’re consistently paying £10 extra per month, that’s £120 a year. That’s worth checking. Call the Student Loans Company at 0300 100 0611 or use their online chat. Have your National Insurance number and payslips ready.

Tracking your student loan repayments isn’t about being perfect. It’s about being aware. You’re not just paying money-you’re managing a long-term financial commitment. The more you understand your payslip, the less stress you’ll have later.