UK Student Loan: What You Need to Know About Funding Your Degree

When you start university in the UK, the UK student loan, a government-backed financial aid program that helps cover tuition and living costs for eligible students. Also known as student finance, it’s the main way most students pay for higher education without needing upfront cash. It’s not free money—it’s a loan you repay once you’re earning above a certain threshold. But for many, it’s the only realistic path to getting a degree.

The tuition fee loan, covers the full cost of your course and is paid directly to your university doesn’t depend on your family’s income. Meanwhile, the maintenance loan, helps with rent, food, and bills, and the amount you get depends on where you live and your household income. If you’re living in London, you get more because rent there is higher. If you’re living at home, you get less. There’s no mystery to it—just clear rules based on your situation.

You don’t have to pay anything back until you’re earning over £25,000 a year. Then, you pay 9% of anything you earn above that. If you never hit that threshold, you never repay a penny. The loan is written off after 30 years, no matter how much you’ve paid. That’s not a handout—it’s a safety net. And it’s designed so you don’t drown in debt before you even start your career.

But here’s what most students don’t realize: the loan doesn’t cover everything. Rent in some cities eats up half your maintenance loan. Groceries, textbooks, travel, and even phone bills add up fast. That’s why so many students end up working part-time, using budgeting tools, or applying for hardship funds. The UK student loan is the foundation—but it’s not the whole house.

You’ll also find that your loan type changes if you’re a postgraduate student, an international student, or studying in Scotland, Wales, or Northern Ireland. Each region has its own rules. A master’s degree? That’s a different loan system. A student from the EU? You might not qualify at all. Even your accommodation type can affect how much you get.

Below, you’ll find real advice from students who’ve been through it. How to stretch your maintenance loan. How to avoid overpaying on bills so you don’t run out of cash by February. How to get extra help if you’ve got a chronic illness, are a single parent, or are struggling with mental health. You’ll see how others managed rent, food, and travel without going into deeper debt. And you’ll learn what most guides don’t tell you—like how to check if you’re getting the full amount you’re entitled to, or how to appeal if your funding was cut.

Published on Nov 26

0 Comments

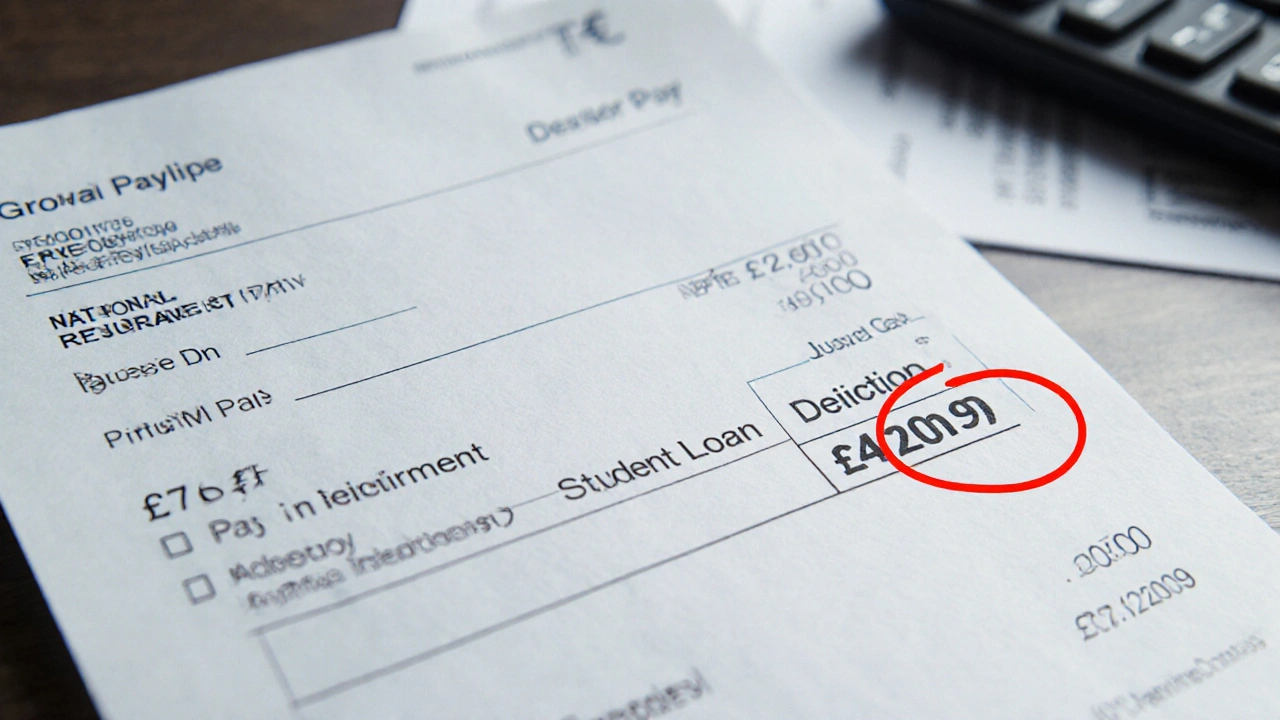

Learn how to read your UK payslip to track student loan repayments, understand Plan 1 and Plan 2 thresholds, spot overpayments, and ensure you're paying the right amount each month.