Student Loan Repayment in the UK: How Much You Pay and When

When you take out a student loan repayment, the process of paying back money borrowed for university in the UK, typically through Student Finance England, Student Awards Agency Scotland, or equivalent bodies. Also known as student debt repayment, it only starts once you’re earning above a certain threshold—no income, no payments. This isn’t like a bank loan. You don’t get chased by collectors. You don’t pay a fixed amount every month. Instead, it’s automatically taken from your paycheck if you’re employed, or you pay it yourself if you’re self-employed—only when you earn more than £25,000 a year (as of 2025).

The student loan thresholds, the income levels at which repayments begin, vary across the UK. In England and Wales, it’s £25,000. In Scotland, it’s £27,660. In Northern Ireland, it’s £22,015. If you earn £26,000, you pay back 9% of everything over the threshold—that’s just £90 a year, or £7.50 a month. Most people never pay back the full amount. The debt is wiped after 30 years, whether you’ve paid £5,000 or £50,000. It’s not a punishment. It’s a safety net. The student loan interest, the rate added to your balance while you’re studying and after graduation, is tied to inflation and your income. While you’re studying or earning under the threshold, interest is at RPI + 3%. Once you earn over £27,295, it rises to RPI + up to 3%. For most, it’s manageable—but it grows faster if you’re not paying down the balance. And if you’re on a low income, working part-time, or taking time off? You pay nothing. No penalties. No late fees. No credit score damage.

There’s no rush to pay it off early. If you’ve got savings, it’s often smarter to invest them or build an emergency fund. Student loans are the cheapest debt you’ll ever have. Compare that to credit cards at 20% APR or personal loans at 8%. Your student loan? Even at its highest rate, it’s usually under 7%. Plus, the system is designed so that if your career doesn’t take off, you don’t get stuck. Thousands of graduates never pay back everything. That’s not failure—it’s how the system was built.

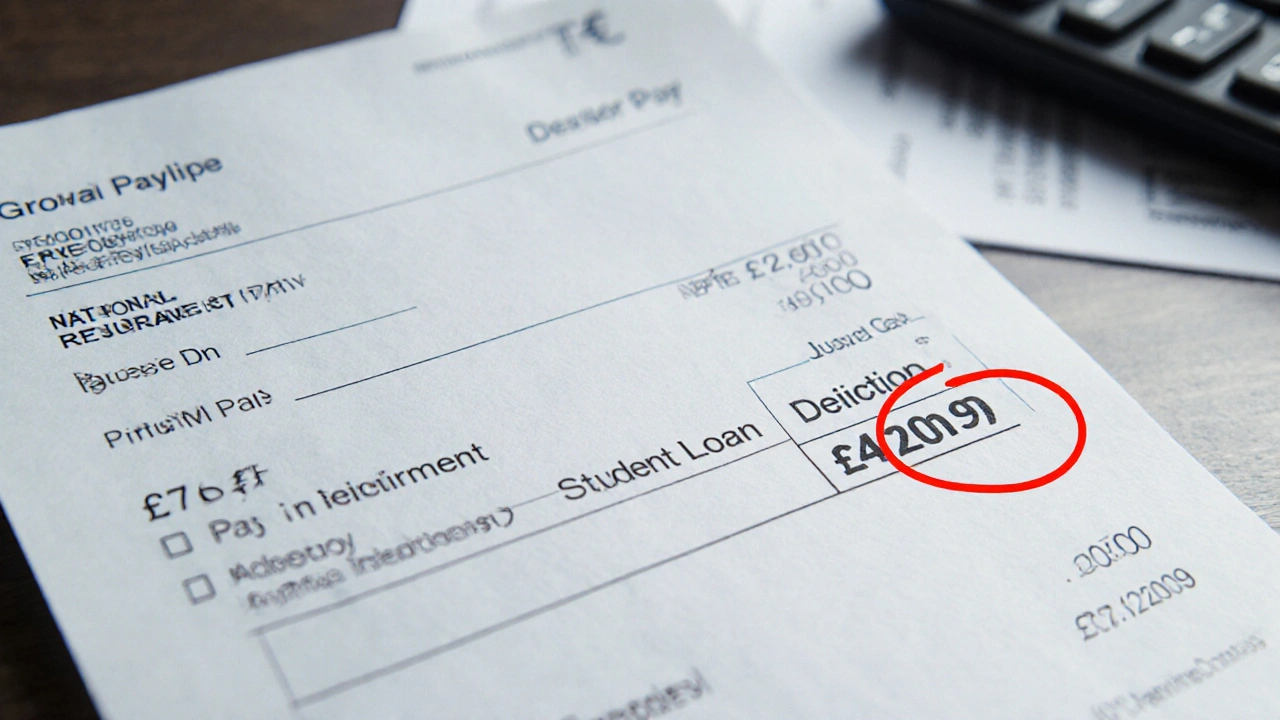

What you’ll find here are real, no-nonsense guides from students who’ve been through it. How to check your balance online. What happens if you move abroad. Why your payslip shows a deduction you didn’t expect. How postgraduate loans work differently. How to avoid scams pretending to be Student Finance. Whether your partner’s income affects your repayments (it doesn’t). You’ll see how students in Manchester, Cardiff, and Glasgow handle repayments differently. You’ll learn how to use the government’s repayment calculator. And you’ll understand why some people pay less than £100 a year—and why that’s perfectly normal.

Published on Nov 26

0 Comments

Learn how to read your UK payslip to track student loan repayments, understand Plan 1 and Plan 2 thresholds, spot overpayments, and ensure you're paying the right amount each month.