Payslip Deductions: What’s Taken From Your Pay as a UK Student

When you start working as a student in the UK, your payslip deductions, the amounts taken from your gross pay before you receive your net income. Also known as take-home deductions, these are legally required and often include tax, National Insurance, and pension contributions. It’s not magic—it’s the system. But if you’ve never seen one before, it can feel like a mystery. Why is £120 gone from your £400 paycheck? What’s this ‘NI’ line? And why does it change every month?

Most students work part-time—whether it’s on campus, in a café, or through a temp agency—and you’re likely on a tax code, a combination of letters and numbers your employer uses to calculate how much tax to take from your pay. If you see ‘1257L’, that’s your personal allowance for 2024/25: £12,570 a year before tax kicks in. But if you’ve had multiple jobs, or your employer doesn’t have your correct details, you might be taxed too much—or too little. That’s why checking your payslip every time matters. National Insurance, a contribution that funds state benefits like the NHS and State Pension. You pay it if you earn over £242 a week. It’s not optional. It’s not a fee—it’s your ticket to future support. And yes, even if you’re only working 10 hours a week, you still pay it. But here’s the thing: you get it back if you overpay. You just have to ask.

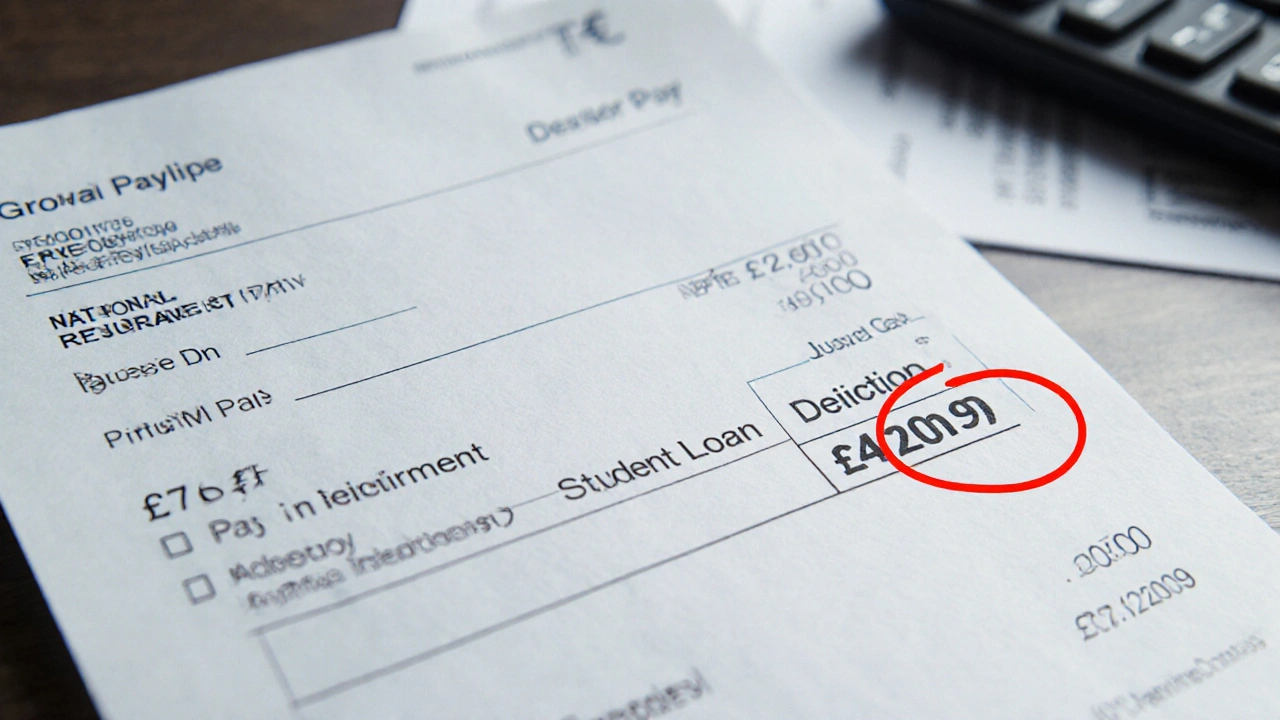

Some students get hit with pension deductions too—even if they’re under 22. If your employer auto-enrolls you (which they must if you earn over £10,000 a year), you’ll see a small percentage pulled out. But here’s the win: your employer adds money too. That’s free cash. Don’t opt out unless you’re absolutely broke. Other deductions? Sometimes it’s union fees, if you’re in a job with one. Or student loan repayments—if you’ve got a Plan 1, 2, or 4 loan, you pay 9% of anything over £22,019 a year. That’s £183 a month. If you earn less, you pay nothing. And if you’re an international student? You still pay tax and NI, but you might be able to claim it back when you leave.

There’s no need to guess. Your payslip isn’t a puzzle—it’s a report card for your earnings. Look for the gross pay, then the breakdown: tax, NI, pension, student loan. Subtract them all, and you get your take-home. If something looks off—like a tax code you didn’t choose, or a deduction you didn’t sign up for—talk to your employer or check HMRC’s website. You’re not being overcharged because you’re a student. You’re being charged because you’re working. And you deserve to know exactly why.

Below, you’ll find real guides from other students who’ve cracked the code on pay, taxes, and hidden fees. No theory. No fluff. Just what actually happens when you get paid as a student in the UK.

Published on Nov 26

0 Comments

Learn how to read your UK payslip to track student loan repayments, understand Plan 1 and Plan 2 thresholds, spot overpayments, and ensure you're paying the right amount each month.