If you're heading to university in the UK, you’ve probably heard the terms maintenance loan and tuition fee loan thrown around like they’re the same thing. They’re not. Mixing them up could leave you short on rent, groceries, or even your textbooks. Understanding the difference isn’t just helpful-it’s essential to making it through your degree without constant financial stress.

What is a tuition fee loan?

The tuition fee loan covers the cost of your course. It’s paid directly to your university or college, not to you. For the 2025/2026 academic year, the maximum tuition fee loan for UK students is £9,535 per year. That’s the full amount most universities charge for an undergraduate degree. If your course costs less, you get less. If it costs more-like some private or international programs-you might need to cover the rest yourself.

This loan doesn’t depend on your household income. Whether your parents earn £20,000 or £80,000, you still get the full tuition fee loan. It’s not a grant. You’ll pay it back later, once you’re earning over £27,275 a year. The repayment starts at 9% of everything you earn above that threshold. Interest builds up while you’re studying, but you won’t owe more than you borrowed unless you never earn enough to repay it.

What is a maintenance loan?

The maintenance loan is what pays for your living expenses. Think rent, food, bus fare, laundry, phone bill, and even the occasional coffee with friends. Unlike the tuition fee loan, this one is means-tested. That means your household income determines how much you get. In 2025/2026, students from lower-income families can get up to £10,702 if they’re living away from home in London. Outside London, the max is £9,077. If you live at home, it drops to £8,084.

Here’s how it works: if your parents earn £25,000 a year, you might get £7,500. If they earn £50,000, you might get £4,200. If they earn over £62,500, you get the minimum amount-£4,780 if you’re living away from home outside London. The government uses your parents’ income from two years ago (2023/2024 for 2025/2026 applications) to calculate your award. That’s why it feels outdated-it is.

Key differences at a glance

Here’s the simple breakdown:

| Feature | Maintenance Loan | Tuition Fee Loan |

|---|---|---|

| Purpose | Covers living costs | Covers course fees |

| Who gets it? | Student | University |

| Amount | Based on household income and location | Fixed at £9,535/year (UK students) |

| Repayment trigger | £27,275 annual income | £27,275 annual income |

| Repayment rate | 9% of income above threshold | 9% of income above threshold |

| Interest rate | RPI + 3% while studying, then RPI or RPI + 3% depending on income | RPI + 3% while studying, then RPI or RPI + 3% depending on income |

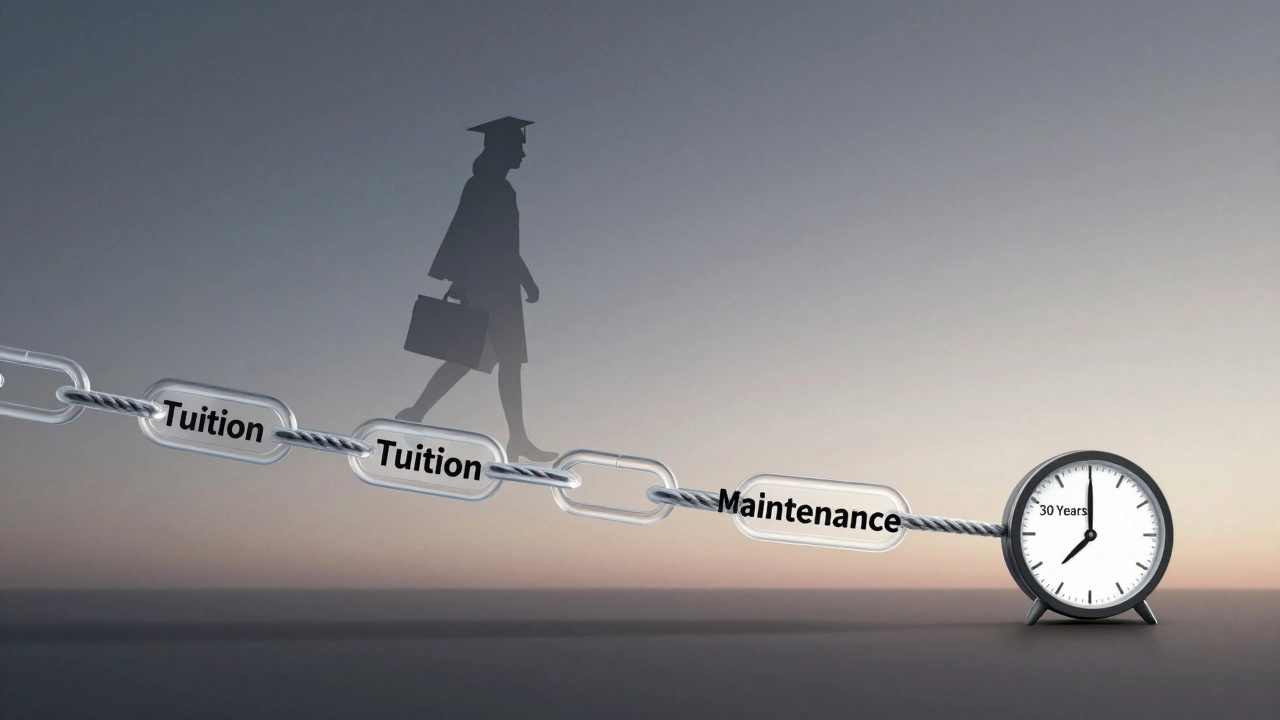

| Forgiven after? | 30 years | 30 years |

Notice anything? The repayment rules are identical. That’s the big myth people get wrong. Both loans are repaid under the same system. The difference isn’t in how you pay them back-it’s in what they’re for and how much you get.

Why the confusion happens

Most students see one lump sum arrive in their bank account each term. They don’t see the split. The Student Finance England (or equivalent body in Wales, Scotland, or Northern Ireland) combines both loans into a single payment. So if you get £12,000 in September, you don’t know how much is for tuition and how much is for rent. The university gets its £9,535 behind the scenes. You get the rest-your maintenance loan.

This design is intentional. It’s meant to make the system feel simpler. But it backfires. Students think they’re getting a big cash gift. They spend it like free money. Then mid-semester, they realize they’ve run out of cash because they didn’t budget for rent, bills, and food separately. The tuition fee loan was never yours to spend. It was always the university’s.

What happens if you don’t get the full maintenance loan?

If your household income is too high, you might get the minimum maintenance loan. That’s £4,780 if you’re living away from home outside London. That’s not enough to cover rent in most cities. Many students in this situation take on part-time work. Some rely on family support. Others cut back drastically-no gym membership, no takeaways, no new clothes. It’s not glamorous, but it’s common.

There’s no extra support for students whose parents earn just above the cutoff. A family making £63,000 gets £1,000 less than one making £62,000. That gap can make the difference between surviving and struggling. No one talks about it, but it’s a real problem. The system doesn’t adjust for regional cost of living differences beyond London. A student in Manchester pays almost as much rent as one in London, but gets the same amount.

Can you get more than these loans?

Yes-but only in specific cases. If you have a disability, you can apply for a Disabled Students’ Allowance (DSA). It doesn’t need to be repaid. If you’re a parent or have caring responsibilities, you might qualify for a Parent’s Learning Allowance or a Care Leavers Bursary. These are separate from your main loans.

Some universities offer their own bursaries or scholarships. These are usually based on financial need or academic merit. They’re not part of the government loan system. You have to apply separately. Don’t assume you’ll get them. Many students miss deadlines or don’t even know they exist.

What about international students?

International students don’t qualify for either loan. They pay full tuition upfront or use private loans, family savings, or scholarships. If you’re from the EU, you might still qualify if you’ve lived in the UK for three years before starting your course. But most international students are on their own financially. That’s why many work long hours during term time-often illegally, because student visas limit work to 20 hours a week.

When do you start paying back?

You don’t start repaying until April after you graduate-and only if you earn more than £27,275 a year. That’s about £2,273 a month. If you earn £25,000, you pay £0. If you earn £30,000, you pay £246 a year. That’s 9% of the £2,725 you earned above the threshold.

Interest is complicated. While you’re studying, it’s set at RPI + 3%. RPI (Retail Price Index) is the inflation rate for things like rent, food, and transport. In 2025, RPI was around 3.8%. So your loan grew at 6.8% while you were in university. After graduation, the rate drops based on your income. If you earn under £27,275, interest is RPI. If you earn between £27,275 and £49,100, it’s RPI + up to 3%. If you earn over £49,100, it’s RPI + 3%.

Most people never pay back the full amount. After 30 years, any remaining balance is wiped. That’s why the system is designed to be forgiving. But it also means many students pay very little-sometimes just a few hundred pounds-over their lifetime.

What if you drop out?

If you leave university before finishing, you still owe what you’ve borrowed. The tuition fee loan covers the portion of the course you completed. The maintenance loan is yours to keep, but you still repay it. You don’t get a discount for leaving early. And you still start repayments once you earn over £27,275. It’s not a refundable loan. It’s a debt.

Some students think dropping out means they can avoid repayment. They can’t. The system tracks you through your National Insurance number. You can’t escape it by moving abroad, either. The UK government can still collect from you if you earn above the threshold in another country.

How to budget wisely

Here’s a real tip: treat your maintenance loan like a salary. Split it into chunks. Rent first. Then bills. Then food. Then transport. Then a small buffer for emergencies. Don’t spend it all in the first month. You’ll be broke by week 10.

Use free budgeting apps like Moneyhub or Moneyhub. Track every pound. Set up automatic transfers to a separate savings account for rent. Even if you only save £20 a week, it adds up. Most students who make it through without debt aren’t rich-they’re disciplined.

And don’t be ashamed to ask for help. Universities have hardship funds. Food banks on campus are more common than you think. Many students use them. You’re not alone.

Final thought

The tuition fee loan isn’t money you receive. It’s a payment made on your behalf. The maintenance loan is the only real cash you get. Treat it like your income. Plan for it. Protect it. Don’t let it vanish before term ends. And remember-neither loan is free. Both will come back to you, with interest, over decades. But if you manage them right, they’ll pay for your future.

Is the maintenance loan the same as the tuition fee loan?

No. The tuition fee loan pays your university directly for your course. The maintenance loan goes into your bank account to cover living costs like rent, food, and bills. They’re two separate parts of student finance with different rules for how much you get.

Can I get more maintenance loan if I live in a more expensive city?

Only if you live in London. Students in London get a higher maintenance loan to reflect higher living costs. Outside London, the amount is the same whether you’re in Manchester, Bristol, or Aberdeen. There’s no extra support for high-rent areas outside the capital.

Do I have to repay both loans?

Yes. Both loans are repaid under the same system: 9% of your income above £27,275 per year. You don’t repay them separately. They’re combined into one debt, and you pay it back together after you graduate.

What happens if I earn less than £27,275 after graduation?

You don’t pay anything. Repayments only start once your income crosses £27,275. If you never earn that much, you never repay. After 30 years, any remaining balance is written off, regardless of how much you’ve paid.

Can international students get maintenance or tuition fee loans?

No. Only UK and some EU students who’ve lived in the UK for at least three years before starting their course are eligible. International students must pay tuition upfront or use private loans, scholarships, or family support.