You’ve landed your first job in the UK. Congratulations. Now comes the part no one tells you about: asking for more money. Most first-time workers accept the first offer out of fear, excitement, or just not knowing what’s normal. But that first salary sets the tone for your entire career. Get it right, and you’ll be earning more for years to come. Get it wrong, and you could be leaving thousands on the table-every year.

What’s a Realistic Starting Salary in the UK?

There’s no single answer, but there are clear ranges based on location, industry, and education. In 2025, the average starting salary for a graduate in England is around £30,000. In London, it’s closer to £35,000. Outside the capital, especially in places like Manchester, Bristol, or Leeds, you’re more likely to see £26,000-£29,000.

But those are averages. Your actual offer depends on what you’re doing. A graduate in software engineering can expect £38,000-£45,000 in London. A marketing assistant might get £24,000-£28,000. A nurse starting in the NHS typically earns £28,407 (Band 5). If you’re not in a graduate scheme, and you’re entering a trade or apprenticeship, £20,000-£25,000 is common.

Don’t just rely on job ads. Check Reed, Indeed, and Glassdoor for recent postings in your exact role and location. Look at the salary range-not just the headline number. If the ad says £25,000-£30,000, assume the lower end is what they’ll offer if you don’t negotiate.

Why You Should Never Accept the First Offer

Employers expect you to negotiate. In fact, many hire managers build in 10-15% wiggle room just for this. If you take the first number, you’re not just accepting their offer-you’re telling them you don’t know your value. And that’s not just about money. It affects how they see your confidence, your assertiveness, even your leadership potential.

A 2024 study by the Chartered Institute of Personnel and Development found that 72% of UK employers were willing to increase their initial offer when asked. The average raise? £3,200. That’s not pocket change. That’s £3,200 more every year, for the rest of your career.

And here’s the truth: most people don’t ask. They think it’s rude. They worry they’ll lose the offer. But in reality, the worst that happens is they say no. And if they say no, you still have a job. You didn’t lose anything-you just learned what their limit is.

How to Prepare: Research, Not Guesswork

Don’t walk into a negotiation blind. You need data. Here’s how to get it:

- Search for your exact job title + location + “salary” on Glassdoor and PayScale.

- Look at the median-not the highest or lowest. Filter by “entry level” or “graduate.”

- Check the Office for National Statistics (ONS) for regional wage trends. They update quarterly.

- Ask people in your network. LinkedIn is full of recent grads happy to share what they got.

- Don’t forget benefits. A £28,000 salary with 25 days’ holiday and a pension match is better than £30,000 with 20 days and no pension.

Write down your target range: a minimum you’ll accept, a realistic goal, and a stretch goal. For example: £26,000 (min), £29,000 (realistic), £31,000 (stretch). This keeps you grounded.

When to Bring Up Salary

Timing matters. Don’t talk money in the first interview. Wait until you have an offer. That’s your leverage. If they haven’t made an offer yet, they don’t have to pay you anything. Once they’ve decided they want you, you’re no longer a risk-you’re an asset.

When they send the offer, don’t reply immediately. Say: “Thank you for the offer. I’m really excited about this role and would like to discuss the compensation before I accept.” That’s it. No drama. No emotion. Just a polite request to talk numbers.

If they push you to say your expectations early, give a range based on your research: “Based on my research, I’m expecting something in the range of £27,000 to £30,000.” That gives you room to move without boxing yourself in.

How to Negotiate Without Sounding Demanding

It’s not about being loud. It’s about being clear and confident. Here’s a script that works:

“Thank you for the offer. I’m genuinely excited about joining the team and contributing to [specific project or goal]. Based on my research into similar roles in [city/industry], the market rate for someone with my skills and experience is between £28,000 and £31,000. I’m confident I can add value quickly, and I’d appreciate it if we could discuss adjusting the offer to £30,000.”

Notice what’s missing? No “I need” or “I deserve.” No apologies. No “I know this might be a lot.” You’re not begging. You’re presenting facts. You’re aligning your ask with the market.

If they say no to salary, ask about other things: signing bonus, remote days, extra holiday, professional development budget, faster review cycle. Sometimes, money isn’t flexible-but time is. Ten extra days of holiday is worth about £2,500 a year in lost income if you’re salaried.

What to Do If They Say No

Don’t panic. Don’t walk away unless you’re truly underpaid. Ask: “Is there any flexibility in the base salary, or is this set by company policy?”

If they say it’s fixed, ask: “Could we revisit this in six months with a formal review?” Get it in writing. A promise like that means something. If they refuse even that, ask: “What would it take to get to £30,000 in the next 12 months?” Maybe it’s hitting specific targets. Write them down. Then decide: is this job worth staying for if you’re not getting paid fairly?

Some companies will say no because they’re small or tight on budget. That’s okay. But if you’re at a large firm and they say no without even trying, that’s a red flag. It tells you they don’t value growth or fairness.

Common Mistakes First-Timers Make

- Accepting the first number because they’re “grateful” for the job.

- Asking for too much too soon-like £40,000 for a £28,000 role. That kills trust.

- Using personal reasons: “I need more because I have rent.” That’s not a business case.

- Waiting too long to negotiate-after you’ve started. It’s much harder then.

- Not getting anything in writing. Verbal promises don’t count.

The biggest mistake? Thinking salary is the only thing that matters. It’s not. Culture, learning opportunities, mentorship, and work-life balance matter just as much. But none of that matters if you’re being underpaid. Money is a signal. It tells you how much they value your work.

What Happens After You Negotiate

If they agree to your number, thank them. Send a short email: “Thank you for adjusting the offer to £30,000. I’m thrilled to join and look forward to contributing.”

If they say no, but you still want the job, say: “I appreciate you considering my request. I’m still very interested in this role and look forward to starting.” Then show up, work hard, and track your wins. When your six-month review comes, you’ll have proof you earned more.

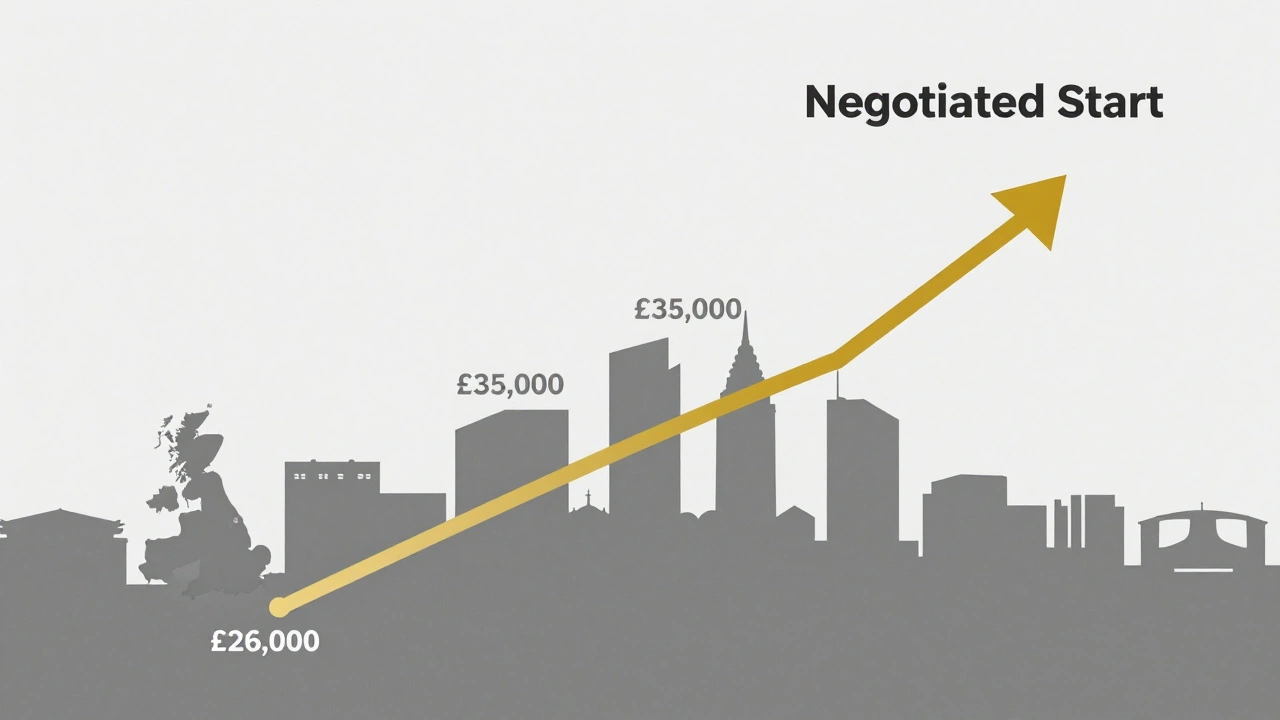

And here’s the secret: your first salary isn’t the end. It’s the start. Every raise, every promotion, every new job will be based on what you earned before. So if you start at £26,000 and get 3% raises, you’ll hit £30,000 in five years. But if you start at £30,000, you’ll hit £35,000 in the same time-without changing jobs.

That’s the power of getting it right the first time.

Final Tip: Practice Out Loud

Negotiation feels scary because it’s unfamiliar. But it’s a skill, not a talent. Practice with a friend. Record yourself saying your script. Say it in the mirror. The more you rehearse, the less it feels like begging-and the more it feels like normal business.

You’ve earned this job. You’re not asking for a favor. You’re asking for fair pay. And in the UK, that’s not just reasonable-it’s expected.

Is it okay to negotiate salary if I’ve never done it before?

Yes, absolutely. Most UK employers expect first-time workers to negotiate. In fact, 72% of hiring managers say they’re willing to increase an offer if asked. It’s not rude-it’s standard practice. The only thing that’s risky is not asking.

What if the company says they can’t go higher?

Ask if there’s flexibility in other areas-like extra holiday, remote work days, a signing bonus, or a guaranteed review in six months. Sometimes, non-salary perks can add up to thousands of pounds in value. And if they refuse everything, ask for it in writing: “Could we confirm in writing that my salary will be reviewed after six months?” That keeps the door open.

How do I know if I’m being underpaid?

Compare your offer to data from Glassdoor, Reed, and the ONS for your exact job title, location, and experience level. If your offer is more than 10% below the median, you’re likely underpaid. Also, if you’re doing the same work as someone else in your team who earns more, that’s a red flag.

Should I mention my student debt or living costs?

No. Salary negotiations are based on market value, not personal needs. Saying “I need more because I have rent” or “I have £40,000 in debt” shifts the focus away from your skills and onto your circumstances. Employers care about what you can do for them-not what you need from them.

Can I negotiate after I’ve already accepted the offer?

It’s possible, but much harder. Once you’ve signed, you’ve agreed to the terms. If you ask for more right after, it can damage trust. Your best move is to wait until your first performance review-usually at six or twelve months-and use your early wins as proof you deserve a raise.

Next Steps: What to Do Tomorrow

- Search Glassdoor for your job title + city. Note the median salary.

- Write down your minimum, target, and stretch salary numbers.

- Practice saying your negotiation script out loud three times.

- If you get an offer, wait 24 hours before replying. Use that time to think.

- Always ask for the offer in writing. Never rely on a verbal promise.

Your first salary doesn’t define your worth-but it shapes your future. Don’t let fear make the decision for you. You’ve worked hard to get here. Now go get paid what you’re worth.