You’re a UK student. Rent’s due next week. Your bus pass ran out. Your laptop’s acting up. And your bank balance? Barely enough for a pint. You know you need an emergency fund-but £500 feels impossible when your maintenance loan barely covers groceries. Here’s the truth: you don’t need a side hustle or a trust fund. You just need a plan, a few small changes, and 10 weeks.

Why £500? It’s Not Arbitrary

£500 isn’t magic. It’s the minimum amount most UK students actually need to survive a real emergency. Think: a broken phone you can’t afford to replace, a last-minute textbook you didn’t budget for, or a sudden dentist bill. The Student Money Advice Service found that 62% of students faced an unexpected cost of £200 or more in 2024. Half of them had to borrow money or skip meals. £500 gives you breathing room. Not luxury. Just safety.

Track Every Penny for One Week

Before you cut anything, know where your money goes. Use your phone’s notes app or a free tool like Monzo or Revolut. Write down every single expense for seven days. Coffee? £3.20. Bus fare? £2.50. Snacks from the campus vending machine? £1.80. That’s £10 a day. £70 a week. In 10 weeks, that’s £700 you could save-if you stop spending it.

Most students don’t realise how much they waste on small, daily things. You think £3 for a latte is harmless. But 5 latties a week = £15. That’s £150 over 10 weeks. That’s 30% of your £500 goal right there.

Slash Your Food Costs

Food is your biggest leak. If you’re buying ready meals, sandwiches, or meals out even twice a week, you’re burning £15-£25 per trip. Swap that.

- Buy rice, pasta, beans, oats, and frozen veggies in bulk. A 1kg bag of rice costs £1.20 and makes 8 meals.

- Cook once, eat twice. Make a big pot of lentil stew on Sunday. Eat it for lunch and dinner all week.

- Use student discounts. Tesco, Sainsbury’s, and Asda have student loyalty cards. Aldi and Lidl are cheaper and just as good.

- Stop buying bottled water. Get a reusable bottle and fill it at campus taps or your flat’s sink.

One student in Manchester cut her weekly food spend from £45 to £18 by doing this. That’s £27 saved weekly. In 10 weeks? £270. Half your goal.

Use Your Student Discounts Like a Pro

You’re paying full price for things you shouldn’t be. You have a student ID. Use it.

- Transport: Get a 16-25 Railcard. It costs £30 for a year and gives you 1/3 off train tickets. Even one round trip to see family saves you £25-£50.

- Entertainment: Student tickets at cinemas are £5-£7 instead of £12. Spotify Student is £5.20/month. Amazon Prime Student is half price.

- Software: Microsoft 365, Adobe Creative Cloud, and GitHub Pro are free for students. Don’t pay for them.

- Shopping: UNiDAYS and Student Beans give discounts on Topshop, Nike, ASOS, and more. Even a 10% discount on a £50 hoodie saves you £5.

One student in Glasgow saved £112 in 8 weeks just by using her student ID for transport and entertainment. That’s £112 you didn’t spend-and now you can save it.

Stop Paying for Things You Don’t Use

Are you still paying for a gym membership you never use? A Netflix subscription you share with your parents? A phone plan with unused data?

Cancel one thing this week. Maybe it’s your Sky Sports add-on. Maybe it’s your Spotify Premium instead of the student plan. Maybe it’s that £12/month app you downloaded once and forgot about.

Most students have 2-3 subscriptions they don’t need. Cutting one £8 monthly fee saves you £80 over 10 weeks. Two? £160. That’s a third of your goal.

Make £50-£100 from Things You Already Own

You don’t need to work 20 hours a week. Just sell what you don’t need.

- Old textbooks? Sell them on Amazon or Bookfinder. Even a £10 book adds up.

- Unused clothes? List them on Vinted or Depop. A few items can bring in £30-£80.

- Extra phone charger? Broken headphones? Someone on Facebook Marketplace will buy them for £5.

- Do you have a spare room? If you’re in university halls, some let you sublet your room during holidays for £100-£200.

One student in Leeds sold 12 textbooks and 8 pairs of shoes for £145 in 3 days. She didn’t work a single extra hour. She just cleared her closet.

Set Up Automatic Savings

Don’t wait until payday to decide if you can save. Automate it.

Open a separate savings account-like a Cash ISA or a simple high-street savings account. Set up a direct debit for £50 every Friday, right after your loan hits your current account. Don’t touch it. Don’t even look at it.

£50 a week = £500 in 10 weeks. Simple. No willpower needed. No thinking. Just moving money before you have a chance to spend it.

What If You Can’t Save £50 a Week?

That’s okay. Adjust.

If you can only save £30 a week, you’ll hit £300 in 10 weeks. That’s still a win. You’ve built a habit. You’ve proven you can do it. Next term, bump it up to £40. Then £50.

Or, stretch the timeline. If you need £500 and can only save £30/week, give yourself 17 weeks. That’s still under 5 months. Better than zero.

The goal isn’t perfection. It’s progress.

What to Do When You Hit £500

Congratulations. You’ve done it. Now, lock it in.

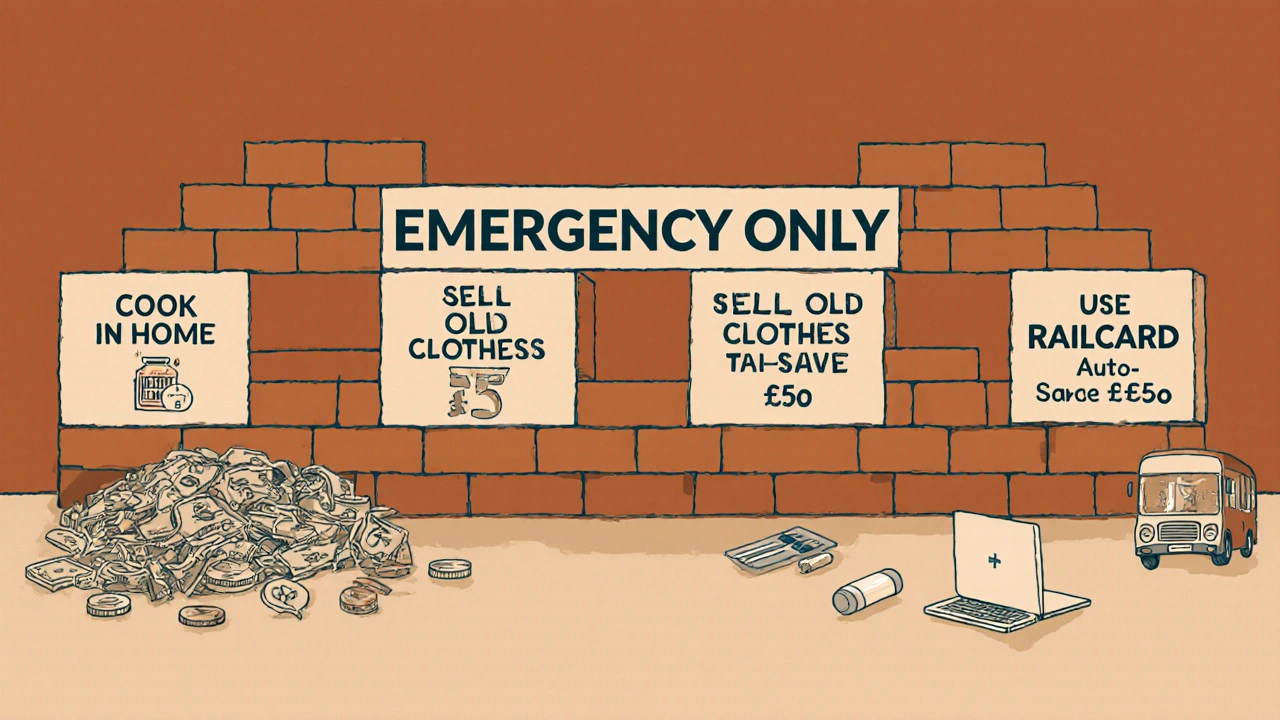

- Don’t move it to your spending account. Keep it separate.

- Label it clearly: “EMERGENCY ONLY.”

- Use it only for true emergencies: medical bills, urgent transport, broken essentials.

- Once you use it, rebuild it. Don’t let it disappear.

After that, start saving for your next goal: £1,000. Or a new laptop. Or a trip home. You’ve already proven you can save. Now you can do more.

Real Student Example: Sarah, 20, Nottingham

Sarah got her maintenance loan on the 1st of every month. It was £700. She spent £550 on rent, food, and bills. The rest? Gone. She felt broke every week.

She started tracking her spending. Found she was spending £40 a week on coffee, takeaways, and impulse Amazon buys. She switched to cooking, used her Railcard for one trip home, and sold 3 jackets on Vinted for £65. She set up a £50 weekly auto-save.

By week 10, she had £512. She didn’t feel rich. But when her laptop died, she didn’t panic. She bought a used one for £220 and still had £292 left. She didn’t ask her parents for help. She didn’t go into overdraft. She just used her own money.

That’s what £500 buys you: peace.

You Don’t Need More Money. You Need Better Habits.

Building an emergency fund isn’t about earning more. It’s about spending less. It’s about making small, consistent choices. It’s about treating your money like something you protect-not something you spend on autopilot.

Start today. Track your spending. Cut one thing. Save £10. Then £20. Then £50. In 10 weeks, you won’t just have £500. You’ll have confidence. You’ll know you can handle whatever comes next.